- Entrepreneurship

- Money and finance

Bootstrap your startup!

What’s better than an experienced entrepreneur advising young entrepreneurs? Marwan Bitar, founder of Innoprofits, agreed to share his advice and expertise on a topic he knows very well related to financing startups and one which can be of interest for many young entrepreneurs: bootstrapping.

photo credit: Dr Martens

Financing a startup is a rollercoaster of successes, failures, and emotions. A mystery for some, a play on word for others. A game of luck, would you say? I’m not so sure, but we can discuss this later if you’re interested.

In the midst of all the available funding opportunities, there are unorthodox funding practices called bootstrapping. Throughout this article, I’ll explain bootstrapping and its applicability in Canada, a practice that I’ve mastered very well after having successfully applied it for my startup, Innoprofits as well as for many of my clients.

What is bootstrapping?

The Wikipedia definition of “bootstrap” is: “loop at the back of boot”, referring to the buckles, in leather or fabric, sewn on the rim of boots, in which we put our fingers in order to help us pull on the boot.

But how is this at all relevant with a startup, you may ask? Easy! As described above with regards to boots, in the world of startups, it boils down to independence and self-sufficiency.

A startup that bootstrapped is therefore a self-sufficient startup that does not need to devote a lot of effort obtaining venture capital funding, or at least not yet.

Let’s remember the word self-sufficiency today.

Who needs it in the startup world?

Everyone.

We just discussed startups that don’t require large investments, venture capital, or angel investors. It must be said that these investors are looking for certain types of startups with a high growth potential. If your startup can provide the required growth rate, consider the following elements:

- The investment research in itself is a full-time job.

- The more investment that comes early in the life of your business, the more you will be diluted.

- Investors also prefer that you have an MVP (Minimum Viable Product) before considering an investment in your business.

Bootstrapping is a smart solution before searching for a first investment.

Finally, if your startup is unable to provide the required growth rates, bootstrap yourself as well!

How to bootstrap?

Two options are available:

- First is the obvious: saving. Both at the level of personal expenses of founders as sooner or later, this ultimately affects the company’s cash flow, as well as the level of business expenses.

- The second option is to make the most of subsidies, grants, guaranteed loans, tax credits, etc. or what we simply call “free money”, as you don’t have to give any part of your business for this money.

Free money? What’s the catch? There is none, and this is because the government will not be throwing money at you. It won’t be taking any risks if you don’t take the money. On the other hand, it’s ready to take a risk with you, if it believes in your project. We must show that we can also take financial risk, this is what’s called “skin in the game”.

Now that we know this exists, what are our next steps?

Always try to create a leverage effect. Each dollar obtained or invested can be doubled or more through public and para-governmental financing programs. We can easily turn $10,000 to $20,000 (FJP), to which we can add $45,000 (Futurpreneur Canada + BDC). To this sum, we can add another $50,000 (NRC) and hiring capabilities of more than $20,000 (CRSNG). Our $10,000 has now allowed us to spend $135,000. These amounts are of course dependent on the type of project, they may be less relevant for certain projects and more relevant for others.

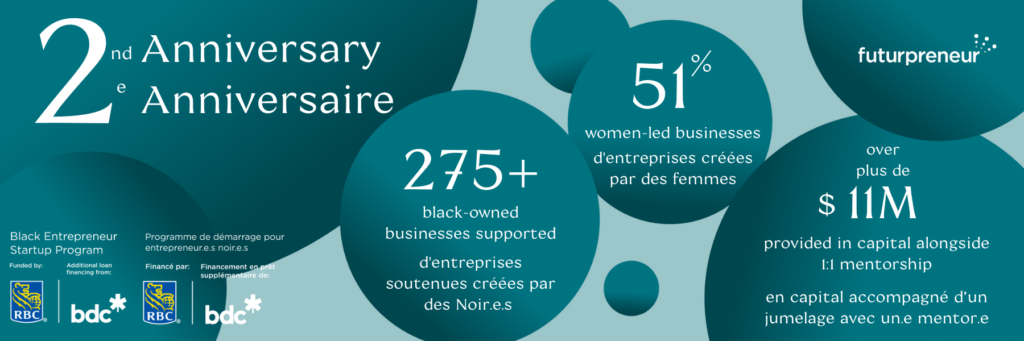

In Québec, organizations such as CLD, Futurpreneur, la BDC, l’ARC, le ME, le MRQ, le Saje, IQ, CNRC, etc. acronyms to no end, provide with personalized financial support. You just have to know how to navigate through these waters.

Written By: Marwan Bitar, Founder, Innoprofits

Innoprofits is a consulting firm that specializes in tax credits and grants. Made up of trained accountants, engineers, software developers, and tech entrepreneurs, the Innoprofits team has supported its clients and partners in a range of areas for seven years. Innoprofits has been investing in the startup community for several years. They designed and offer a one of a kind startup program in terms of support and pricing that addresses the challenges and realities of entrepreneurs.